Do you want to purchase or refinance multiple investment rental properties? Partner with Freedom Legacy Lending for a long-term solution to consolidate your rental properties and generate cash flow.

Term | 30-Year term, Fixed Rate Mortgage (Fully Amortizing) 5/6, 7/6, 10/6 Hybrid ARMs (Partial IO or Fully Amortizing) |

Lease Requirements | Minimum Occupancy Rate of 90% by Unit Count Leased Units: Lower of (i) In-Place Rent & (ii) Market Rent Unleased Units: 90% of Market Rent (Purchase Loans only) |

Recourse | Full Recourse with Pledge of Equity of Borrowing Entity |

Loan Purpose | Blanket loan for purchase, rate-term refinance, or cash-out of a portfolio of rental properties |

Minimum Fico | 680 |

Borrower Type | Entity required |

Interest Rate | Call for quote |

Property Type | Non-Owner Occupied: Single Family Residences (SFR) 2-4 unit properties Warrantable condos Townhomes PUD |

Minimum debt service coverage ratio (net cash flow/debt service) | 1.20x |

Vacancy Minimum | Min. 90% occupancy rate by unit count |

Rural Properties | Not permitted |

Foreign Nationals | Eligible at maximum 65% LTV |

Loan Amount | Minimum Property Value: $100K Maximum Loan Amount: $2MM |

Property Restrictions | No vacation or seasonal rentals |

Maximum Loan-To-Value (Ltv) | Up to 80% on purchase and refi. Up to 75% on cash-out |

Seasoning Requirement (To Use Value Vs. Cost Basis) | 180 days |

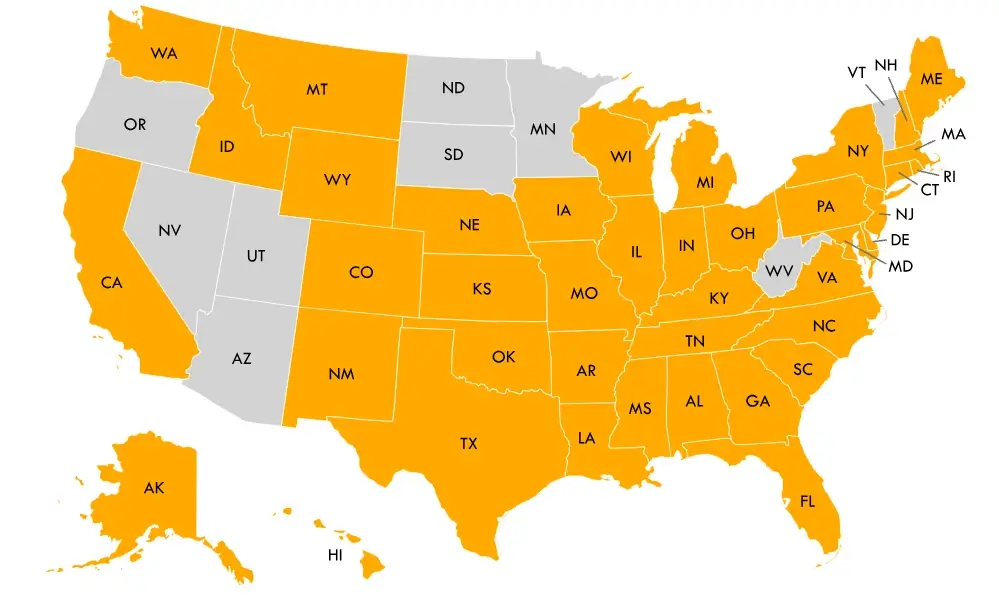

DISCLAIMER: Programs not available in the following states: Arizona, Minnesota, Nevada, North Dakota, Oregon, South Dakota, Utah, Vermont and West Virginia. All information contained herein is for informational purposes only and, while every effort has been made to insure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval.