If you’re looking to fund a short-term loan on an investment property, our Bridge Loan program provides you with the flexibility!

|

|

1-4 UNIT BRIDGE LOAN

|

|---|---|

|

LOAN PURPOSE

|

Bridge loan ideal for temporarily holding assets, floating the market

- Property as-is must be 100% complete and marketable or rent ready - Purchase and refinance transactions eligible |

|

Loan Amount

|

$75K - $2MM

|

|

LOAN TERM

|

12 months standard,

18 month option case-by-case |

|

BORROWER TYPE

|

Entity required

|

|

MINIMUM EXPERIENCE

|

Real estate experience required

|

|

MAXIMUM LOAN-TO-VALUE (LTV)

|

Up to 70% LTV

|

|

MAXIMUM LOAN-TO-COST (LTC)

Cost is purchase price amount |

Up to 85% LTC

|

|

When do we use Cost Basis?

|

Used on purchases and refinances owned < 365

days Cost Basis is defined as [Purchase Price + cost of work already completed (verified and provided by Inspector)] |

|

Rehab Allowed

|

See Fix & Flip product page if rehab is needed

|

|

Foreign Nationals

|

Not allowed from ineligible country list

|

|

Property Type

|

Non-Owner Occupied:

- Attached or detached SFR - 2-4 unit residential properties - Townhomes - Condos |

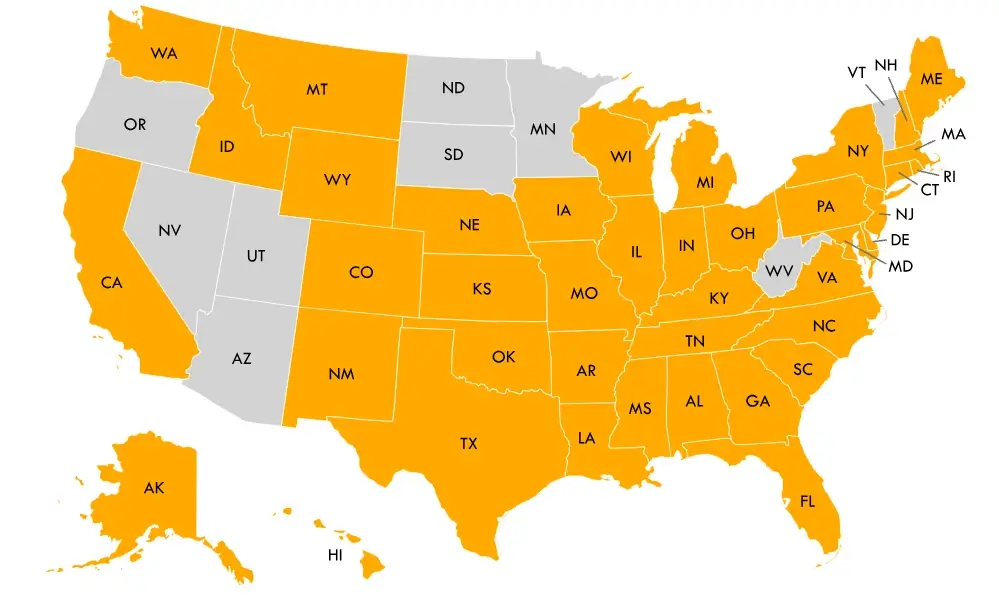

DISCLAIMER: Programs not available in the following states: Arizona, Minnesota, Nevada, North Dakota, Oregon, South Dakota, Utah, Vermont and West Virginia. All information contained herein is for informational purposes only and, while every effort has been made to insure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval.