Our Construction Loans provide builders and investors the financing they need for ground-up construction and land acquisition.

| Ground Up Program | Experienced Developer Program (3+ Similar Past Projects) | |

|---|---|---|

Maximum Loan To Cost | Up to 75% of the lower of land value or purchase price/60% if unpermitted, plus 100% of construction Max 85% of total project costs LTC Catch Up Draw to raise initial advance to 75% at approval of required plans/permits post-closing | Up to 75% of the lower of land value or purchase price/60% if unpermitted, plus 100% of construction Max 90% of total project costs LTC Catch Up Draw to raise initial advance to 75% at approval of required plans/permits post-closing |

Maximum Loan To Arv | Up to 70% | Up to 70% |

Recourse | Full Recourse | Full Recourse |

Reserves/Escrows | Interest Reserve: Minimum 1 month | Interest Reserve: Minimum 1 month Minimum 6 months full boat IR funded with initial loan amount for 90% LTC loans |

Experience | Previous real estate experience required: 1-2 Ground ups GCs if experience if permits tie to Ground ups Guarantors with no experience permitted on a case by case basis | Previous real estate experience required: 3+ similar Ground-up builds + heavy rehabs with expansion. Professional deveopment / builder. Guarantors with no experience permitted with experienced guarantor that meets the above experience criteria |

Loan Amount | Min: $50,000 Max: $3,500,000 | Min: $50,000 Max: $3,500,000 |

Term Length | 12 months, Up to 18 at Lender Discretion | 12 months, Up to 24 at Lender Discretion |

Property Count | Min: 1 Max: 2 | Min: 1 Max: 10 |

Permitted Property Types | Eligible: Non-owner Occupied 1-4 unit residential Townhomes Condos Ineligible: Mixed use properties 5+ unit multifamily properties Condotels Co-ops / TICs Commercial Property Log Homes Properties Subject to Oil and/or Gas Leases Operating Farms, Ranches, or Orchards Vacation or Seasonal Rentals Rural properties | Eligible: Non-owner Occupied 1-4 unit residential Townhomes Condos Ineligible: Mixed use properties 5+ unit multifamily properties Condotels Co-ops / TICs Commercial Property Log Homes Properties Subject to Oil and/or Gas Leases Operating Farms, Ranches, or Orchards Vacation or Seasonal Rentals Rural properties |

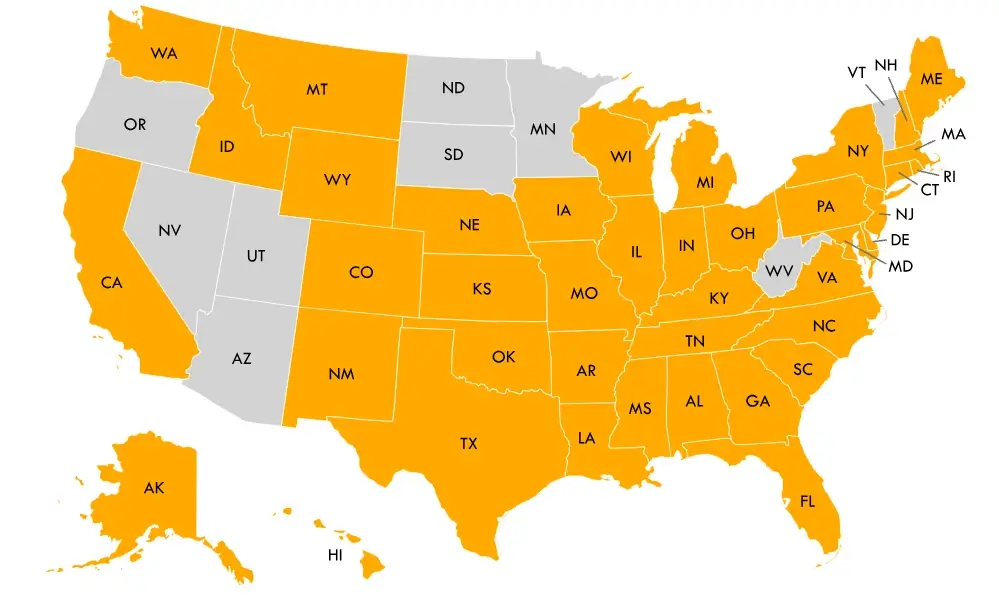

DISCLAIMER: Programs not available in the following states: Arizona, Minnesota, Nevada, North Dakota, Oregon, South Dakota, Utah, Vermont and West Virginia. All information contained herein is for informational purposes only and, while every effort has been made to insure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval.